Being an insurance broker, learning how to increase your insurance brokerage on a consistent basis is one of the top priorities. Here we are explaining some of the most recommended strategies that can be useful for growing your insurance brokerage.

Setting practical goals

“Practical” in the sense, priorities that can help you in achieving both your personal as well as professional goals. The reason is, if you are not aware of your target objective, you might be distracted from the success pathway and may end up with something different. For that, first, you have to differentiate your short term and long term goals. If possible take a few minutes to write down your aims and review them on a periodic basis.

Create the right cuisine for your targeted audience

Finding your target audience and serving them with quality products and services is the key to success. Doing the proper groundwork will definitely improve the likelihood of creating more business prospects and converting those leads to potential businesses.

Setup a contact and follow-up strategy

Shaking hands and signing deals within the initial conversation is the dream of every insurance broker. But in a practical sense, every successful broker knew that seldom happens. That’s why the idea of a structured contact and follow-up strategy comes in demand. This helps the broker to deal with their prospects in a professional as well as a timely manner.

Also read SIBRO’s Automated Policy Management– Elevating the Pitch for Insurance Broker Profitability

Invest in yourself

Never stop learning. One of the big mistakes that even successful professionals make is that they rest on their glory after a short term achievement. You have to understand that customers and their mindset will always be on the changing side, so being an insurance professional you have to stay ahead of the curve. Consider which part you would like to focus on improving, start reading some blogs, search for more detailed information, and make yourself understand. When you devote yourself, you empower the future of your business and in every person who works with you.

Compact emails for better readability

The most ideal length of a readable email is between 50 to 125 words. When you exceed that limit, chances of reading that email by your prospects become less and less. Always try to point out the features and focus on what they need exactly. Highlight them so that they catch them in a single view. They will definitely come for you.

Own a professional website

The website reflects who you are and what you do. Owning a professional website will definitely boost your value and trust in the eyes of customers. Possibly the most vital question is, “does your website make it easy for guests to find your contact info and reach you?” If this isn’t easily found on your website, you’re likely losing possible leads to your competitors. So invest in your website, the results will be self-driven and astonishing.

Automating your business process

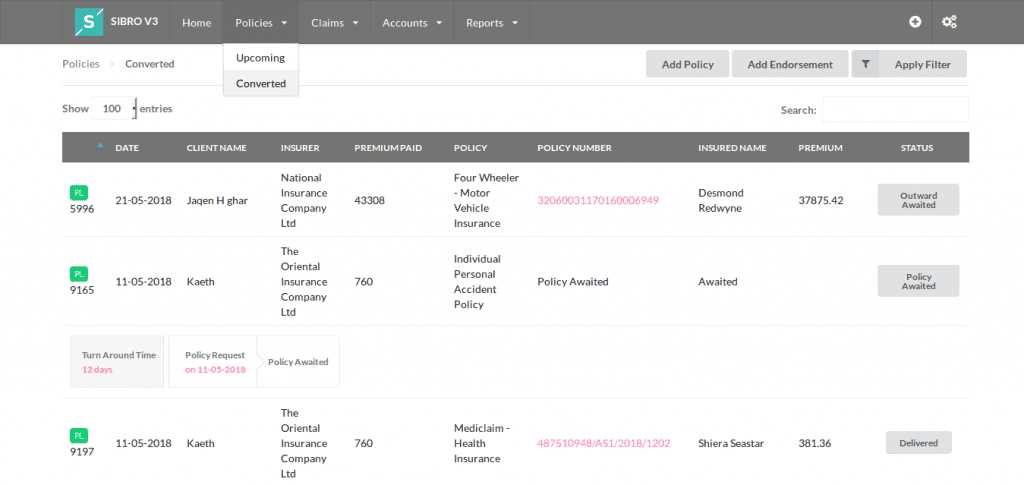

If you can switch into a software managed business process, you could benefit a lot. Forget about the initial investment because it going to return to you in terms of prospective business outputs. The flexibility in business process handling and accuracy in outputs with less effort and time is the core benefit of switching to a software version. Your pressings tasks such as policy management, claims, Invoicing and reconciliation, everything can be handled smoothly and flawlessly with the help of an insurance management software

SIBRO offers more than you THINK!

We waited until we could do it right. Then we did! Checkout the incredible features of Sibro, the most recommended insurance broker management software in India, Philippines and Botswana..

SEE ALL SIBRO FEATURES

Best Insurance CRM Software for Brokers