As per the latest regulations by The Insurance Regulatory and Development Authority (IRDA) in India, all insurance brokers are advised to use any insurance management software so that it may facilitate better customer service and audits.

This article will walk you through the top 7 best insurance agency/broker software in India.

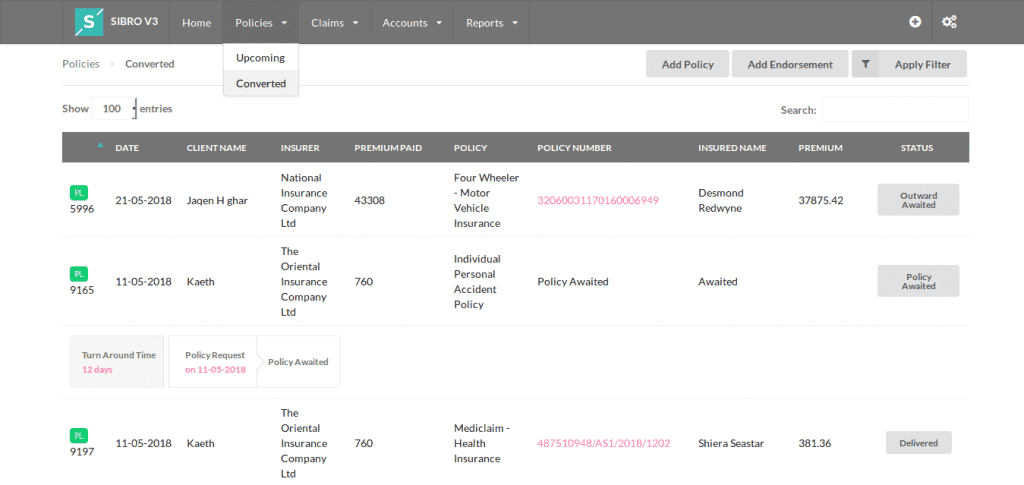

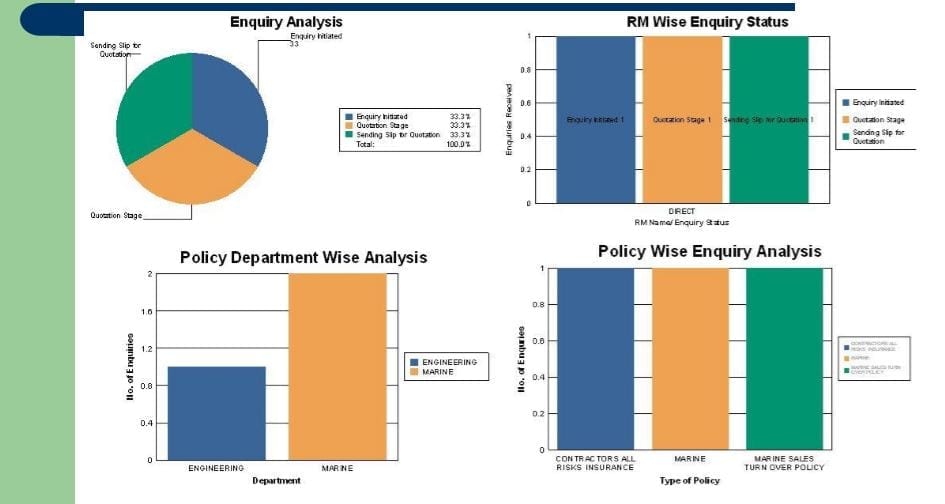

1. Sibro

If you haven’t heard about Sibro in the past, you may be wondering why Sibro stands as the best insurance software in India. Sibro is an all-in-one solution to handle the insurance business. Some CRM companies create and promote software that works for certain companies but not for all. But before creating Sibro, the team have conducted in-depth research on what an insurance broker/agent exactly wants from a software. The features evolved are the result of that. No matter the number of clients you have, you will be aware of each and every stage of policies and claims with the help of Sibro.

Its benefits are:-

- Ability to create and send RFQs to clients directly from the software

- In-built emailing and WhatsApp integration. Whatever policies documents or information you want to mail your clients, you can send it simply by a click from the software itself

- Keep track of payments of every policy stage whether they are partially or fully paid

- Sibro can suggest the documents required for a claim. It can even fetch real-time claim updates via TPA integration.

- Ability to create invoices and send directly to clients from the software

- Sibro’s accounts module systematically corrects mistakes & ensures overdue receivables

- Sibro helps you track every receivable invoice and their reconciliation. It also exposes cases where we missed receiving brokerage

- Sibro also has a growing list of action-oriented reports; which provides precisely the information you need.

Know more about Sibro. Click here.

2. Broker Edge

BrokerEdge is an easy-to-configure broker management software that is user-friendly, flexible, scalable, and has the capability to work with multiple insurance companies in conjunction. It is helping them manage administration, client services, underwriting, quote processing, claim processing, CRM, Customer Portal and configurable mobile app. It can manage all classes of the insurance business, namely Property & Casualty lines, special lines, Life, International Health, Employee Benefits, Life Insurance, and more.

Its benefits are:-

- Single Unified Customer View

- Document Management

- Increased Efficiency and Productivity

- Better Customer Relationship

- Process Automation and Management

- Lead Management

Know more about Broker Edge. Click here.

3. SAIBA

An end to end solution from CRM to balance sheet. An ERP for insurance brokers which covers almost all aspects of the insurance broking industry. SAIBA is also capable of consolidating all the activities of Insurance Brokers, which helps in retaining the existing business as well as getting new business by providing a handful of information and various analysis support.

Its benefits are:-

- Easily customizable according to needs.

- Very user-friendly, minimal training required

- SMS & Emails: supports both text and uni-code formats

- Print policies, cover notes, stickers, broker slips risk notes, debit notes, credit notes, receipts, etc in your own formats.

- Renewal Tracking: State of the art renewal management system through notices, email, and SMS.

- Regulatory Reports: Get regulatory reports exactly in the formats required by your regulator, customization free of cost till SLA is in force.

- Service & Support: State of the art support service with no hidden cost and active remote support available to the customers during the office hours.

Know more about SAIBA. Click here.

4. Custom Soft

Custom Soft deeply has knowledge of integrating broker software and providing services to many clients with the need for such products across the countries like US, UK, Canada, Australia, and India.

Its benefits are:-

- Complete policy administration life cycle including all issues of quotes, binding, rates

- Custom Soft delivers the broker software with total front and back-office functionality

- Claims management is the main feature gives detailed reports

- Completely automated claim settlements services

- The billing collection system has flexible and dynamic methods of Payment

- Workflow system management keep complete follow-up of all related activities

Know more about Custom Soft. Click here.

5. SohamIBM

SohamIBM Broker Software is built exclusively for Insurance Brokers to automate their business transactions. It is a highly flexible and configurable suite of functionalities, dedicated to support and enable the needs of individual brokers and Reinsurance brokers. The Application covers the complete life cycle of brokers business, including customer management, claims registration, reinsurance, treaty management, accounts management, etc.

Its benefits are:-

- Easy to use and relatively simple to learn

- Centralized customer-centric system

- Accessible anytime anywhere

- Multi-Lingual and Multi-Currency Support

- Automatic generation of MIS reports

- Highly Scalable & Secured

Know more about SohamIBM. Click here.

Also read Insurance CRM Software: The Winning Edge for Your Insurance Broking Business in the New Normal

6. My Insure Book

MyInsureBook is a cloud platform for Insurance Agents, Brokers, and Corporate Agents. You can track all your Sales Personnel like Tele-Sales, Field Staff, Direct Sales team in the software and assign leads to each of them. Each Policy document can be uploaded into software and kept safely, which you can download and share with your customers anywhere any time in case of Claim or in any emergency.

Its benefits are:-

- Premium Calculators

- Customer Tracking

- Renewal SMS Reminders

- Schedule Meetings

- Document Tracking

- Customer Wishes

Know more about My Insure Book. Click here.

7. Openstride IBMS

Insurance Brokerage Management System is built on a mature CRM platform that has been used by small and large insurance brokerage companies alike. This software is installed in the cloud and can be accessed using a browser by multiple users. OpenStrides completely manages the software updates and securely backs up the data. All this comes without the need for any capital investment.

Its benefits are:-

- Secure & Password-protected Internet-enabled solution

- Record Insurance and Endorsement information

- Store policy documents, proposals, claim forms against policy records for easy lookup

- Record payments and structure future payments

- Record claims against policies for easy referral and to assist in the policy renewal process

- Record Brokerages against payments

Know more about Openstride IBMS. Click here.

SIBRO offers more than you THINK!

We waited until we could do it right. Then we did! Checkout the incredible features of Sibro, the most recommended insurance broker management software in India, Philippines and Botswana..

SEE ALL SIBRO FEATURES

Best Insurance CRM Software for Brokers

We hope you have got a clear cut idea of the best insurance software available in the market right now. Cross-check the features, understand what you need exactly, and grab your best pick.