Insurance software products have become indispensable tools for the modern insurance broking industry. With numerous options flooding the market, choosing the right brokerage software products is crucial for success. For all the ambitious insurance brokers out there, precision in your selection is paramount. If you possess the keen judgment to closely assess these features and align them with your specific business needs, you’ve just made a significant stride in the world of insurance brokering. The next step is selecting a swift, capable, and cost-effective insurance software solution – a decision that will shape your future.

Blog Summary

In this article, we have presented you with a curated list of the top-rated insurance software products tailored for insurance brokers in India, Botswana, and the Philippines. You'll discover their unique features and functionalities, helping you make an informed decision for your insurance brokerage business.

Sibro V3 Insurance Broking Software

Insly

i2go Insurance Software Solution

AdminSeg Insurance Portfolio Management System

SAIBA Insurance Management Solutions

KAEM-Auto Insurance Claim Tracking Software

Attune ClaimBook Case Management System

InsureEdge Policy Administration & Claims Management Software

Partner XE

HawkSoft CMS

Let’s embark on this journey together.

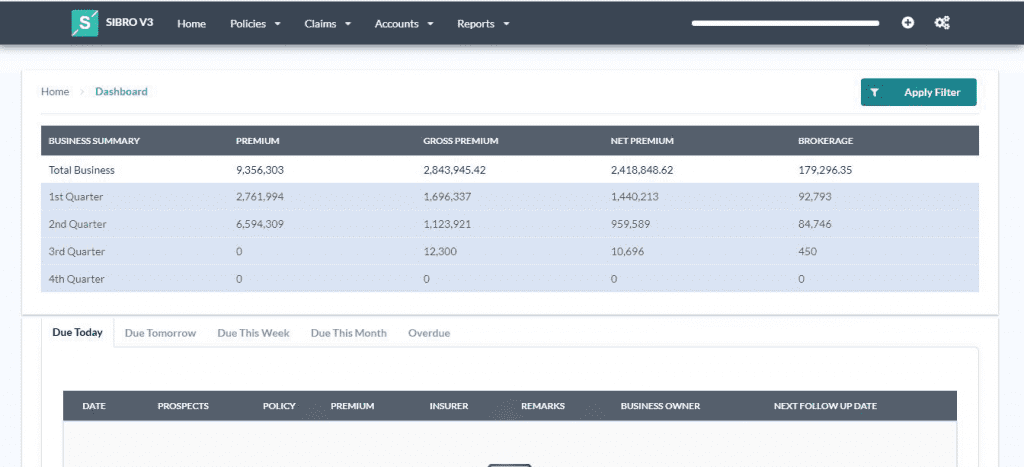

#1: Sibro V3 Insurance Broking Software

Being one of the best IRDAI compliant broker software, Sibro helps you organize and track prospects management, renewal follow-ups, preparation of RFQs/quote comparison, collecting payments, and delivering policies to customers in order, their endorsements, and more. Sibro’s accounts module systematically corrects mistakes & ensures our due receivables. It helps you track every receivable invoice and its reconciliation. It also exposes cases where we missed receiving brokerage.

Check out its features:-

- Sibro allows you to upload and save an unlimited amount of policy and claims related documents into the system.

- Sibro will remind you about all the pending business with a variety of views like All, Due Today, Due Tomorrow, Due this Week, Overdue, etc

- With Sibro, you can translate any data entry fields in your own language whenever you want

- You can create and send RFQs to clients directly from the software.

- Sibro’s claims module not only helps you track but also automates & eases your work.

- Sibro has a growing list of action-oriented reports; which provides only the information you need.

Click here to know more.

#2: Insly

Insly is an easy to use interface for brokers where you can systematically add policies, navigate between clients and corresponding claims, manage invoicing, etc. Insly is completely web-based and that’s why you don’t need to lose sleep about hosting, backups, etc.

Check out its features:-

- Full-featured policy administration

- Performance dashboard to visually track your business growth

- Real-time business insights to understand how your business is performing

- Insurer reports to know what you owe your insurers

- Create and send professional looking client invoices individually, in bulk, etc

Click here to know more.

#3: i2go Insurance Software Solution

This is robust, cloud insurance software that gives you the power to transform 100% of your business digitally. i2go has all the necessary firepower to scale up your business and can digitalize all your existing insurance processes.

Some of its major features are:-

- Automate the entire policy life cycle

- Handle the full claim process from FNOL to the repayment for policyholders

- Easily add or remove elements to configure products

- Track critical information and nicely display it on the dashboard

Click here to know more.

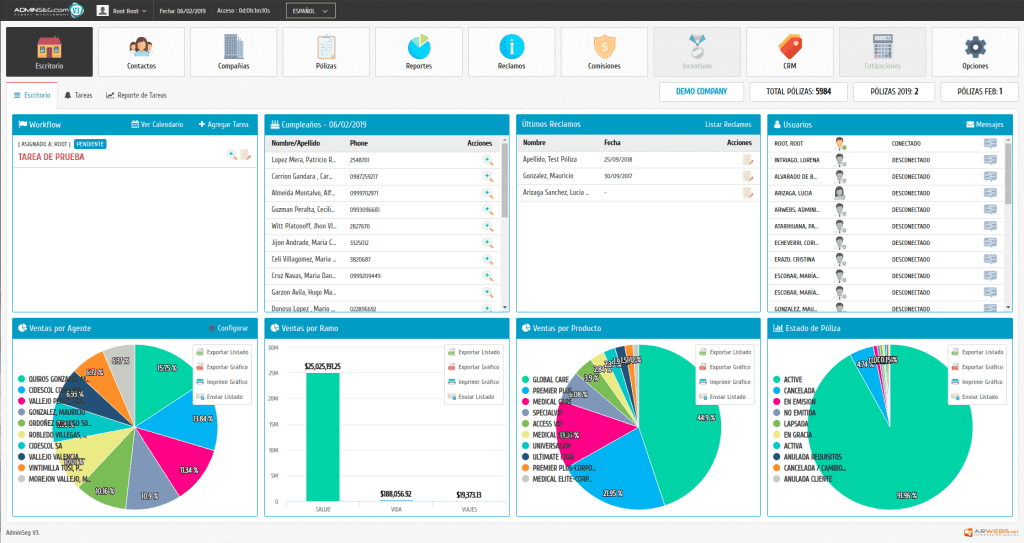

#4: AdminSeg Insurance Portfolio Management System

AdminSeg is a complete portfolio management system for insurance providers, brokers, agencies, and every professional in the insurance industry to manage their businesses in a professional and efficient manner.

Some of its major features are:-

- Advanced design, flexible, adaptable to any use.

- Systematic policy administration, generate reports in real-time. renewals, expiration alerts, payments, etc

- 100% compatibility with accessibility to your information anywhere, any time

- Automated reports, receive reports via e-mail: sales, renewals, claims, etc.

Click here to know more.

#5: SAIBA Insurance Management Solutions

SAIBA is a self-service web-based platform for brokers with a single unified view of your customers and offers full support for all types of insurance products. It is easily customizable; an end to end solution from CRM to balance sheet.

Some of its major features are:-

- Print policies, cover notes, stickers, broker slips risk notes, debit notes, credit notes, receipts, etc. in your own formats

- Easily customizable according to the requirements

- Very user-friendly, minimal training required

- Integrated email, SMS, and electronic document management to assist brokers in their day to day business

Click here to know more.

#6: KAEM-Auto Insurance Claim Tracking Software

KAEM offers an efficient auto insurance claims management software designed to expedite the process of getting customers back on the road. Their intelligent automation simplifies the claims process for insurers, assessors, repairers, and customers. With features like customizable workflows, task triggers, remote assessment capabilities, and integration with repairer software packages, KAEM’s software provides a comprehensive solution. It enables real-time monitoring of claims progress and offers in-depth reporting on costs, durations, repair types, and repairer performance, making it a valuable tool for enhancing efficiency and customer satisfaction in the auto insurance industry.

#7: Attune ClaimBook Case Management System

Attune’s ClaimBook Case Management System is a powerful tool for managing health insurance claims. It’s particularly beneficial for hospitals, as it expedites the discharge process for insurance patients and optimizes revenue collection by ensuring efficient bed care days, which leads to increased revenue. Additionally, it helps in preventing revenue losses associated with payment collections from third-party administrators (TPA) and insurance companies. Attune ClaimBook offers various features such as physician management, electronic medical records, claims tracking, budget management, claim trend analysis, expense tracking, PACS support, and client management with credit control.

By leveraging these features, hospitals can streamline their operations and enhance revenue streams. The system also allows for easy comparison of pricing plans to ensure healthcare providers choose the most suitable software to meet their specific needs. Attune ClaimBook simplifies health insurance claim management, offering hospitals a comprehensive solution for more efficient and profitable healthcare services.

#8: InsureEdge Policy Administration & Claims Management Software

InsureEdge is a comprehensive policy administration and claims management software that offers insurance companies the ability to enhance their operational efficiency. This all-in-one solution facilitates the streamlined management of key processes, encompassing customer onboarding, policy administration, claims processing, and reinsurance. With features such as cancellation tracking, quotes and estimates, commission management, policy issuance, compliance management, flat commissions, and policy administration, InsureEdge provides insurers with the tools needed to optimize their workflows.

Insurance companies can benefit from increased productivity and a more efficient approach to managing policies and claims by utilizing InsureEdge. By exploring the various features and comparing pricing plans, insurers can choose the right software that aligns with their business needs. InsureEdge is designed to unlock the potential of seamless operations within the insurance industry, offering a comprehensive solution to improve productivity and customer satisfaction

#9: Partner XE

Partner XE is a favored choice among insurance agencies for its cost-effectiveness and user-friendly interface. This insurance software offers robust features that encompass contact management, commission tracking, document management, and policy management, providing agencies with a comprehensive tool for their operations. Additionally, Partner XE provides valuable support during business hours, ensuring that agencies have the assistance they need when it matters most.

Insurance agencies looking to optimize their operations can benefit from exploring the various features of Partner XE, comparing pricing plans, and selecting the right software to meet their specific business requirements. With features like policy processing, claims tracking, and policy generation, Partner XE offers an efficient and reliable solution for insurance agencies seeking to enhance their productivity and client services.

#10: HawkSoft CMS

HawkSoft CMS stands out as a robust and promising insurance policy management software, earning the preference of many insurance agencies. It distinguishes itself by its user-friendly and intuitive design, making it effortless to navigate. With HawkSoft, insurance agencies can efficiently manage essential aspects of their business, including client data, signature forms, and image records, all without any hassle.

This comprehensive software offers a range of features, including contact management, document management, policy management, quote management, insurance rating, commission management, and claims management. These features collectively empower insurance agencies to streamline their operations and deliver effective client services. HawkSoft CMS is a valuable tool for agencies seeking to enhance their productivity and manage their insurance policies with ease.

SIBRO offers more than you THINK!

We waited until we could do it right. Then we did! Checkout the incredible features of Sibro, the IRDAI compliant broker software in India, Philippines and Botswana.

SEE ALL SIBRO FEATURES

Best Insurance CRM Software for Brokers