Computerization is a continuous drift that is happening in all industries and insurance broking business is no different. Insurance brokers are someone who have access to an array of insurance products and have the skill to pact with a variety of insurance companies. Beyond normal insurances services, brokers are able to present multiple choices of insurance products, analyze risk factors, giver quality product feedback, help employees in final settlement of claims and a lot more. Insurance broking softwares play a significant role here. They offer a cutting edge advantage over others who doesn’t have that computerized support.

Let’s see how softwares serve as a cutting edge toot for insurance brokers.

Providing improvised customer experience

This is one of the foremost major challenge that every insurance brokers face. Customers are now well versed with the different types of softwares and the amount of data it provides them for any type of analysis. So before carrying out any buying process nowadays, people will d their own lithe research online. In order to compete with that, the insurance broker is supposed to provide high quality crystal clear information that can vary from one client to another.

How software helps in this context?

What if your insurance broking software is able to give you reports about your customer’s past insurance transactions provided if they have deal previously with you? The previous financial data, policy notes, emails etc all at your finger tip. How will it help you in dealing with your potential customers? Think about it.

All-In-One Dashboard

Being an insurance broker, you might be totally aware about loss of time when working across different portals and other physical document directories to access the information that you need urgently. Not just the time but also the effort that you invest is something that you want to forget each time.

But with the help of an insurance broking software, you can now access everything in a in a comprehensive dashboard. All the records, data and numbers displayed in an organized manner. Getting everything in a single place when needed is an added advantage. Think how easy for you to work out your business with these.

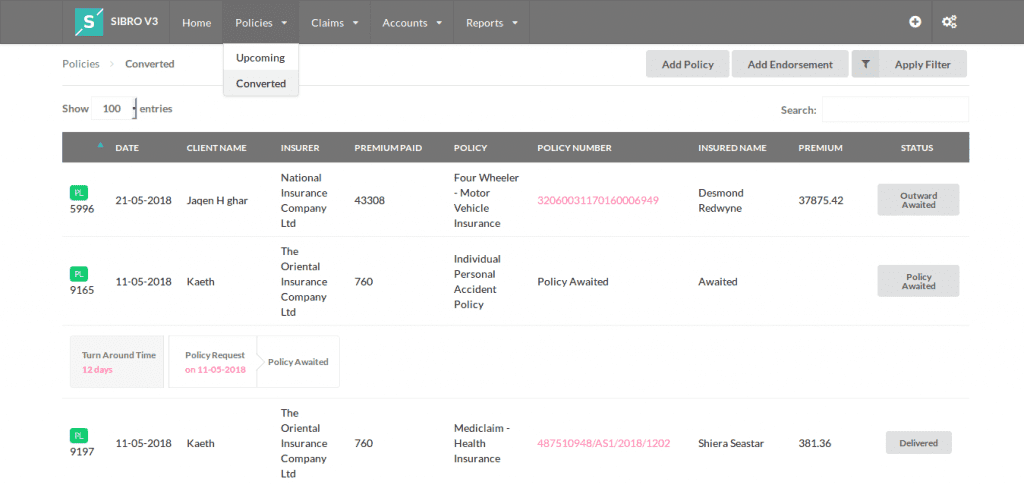

Imagine a software that can exclusively manage your day-to-day insurance activities and recording all your prospective customers, track their premiums, manage the claims, auto-reconciling the monthly statements from the insurance companies with your business that you have done. If you feel the necessity of all these; these, they you should definitely consider check Sibro, an all in one insurance management software.

Sibro helps you organise and track every stage of a policy; from prospects & renewal followups, preparation of RFQs and quote comparison, to collecting payments, and delivering policies to customers in order, their endorsements, and more. The features of Sibro are tailored solely for the orderly administration of insurance broking services.

Let’s see some of the features possessed offered by Sibro.

- End to end Policy management

- Automated, hassle-free Claims management

- Invoicing & Reconciliation

- Actionable Reports and lot more

Also read A Complete Insurance Management Software

So being a part of a competitive field, you should definitely consider opting any of these magic tools all the way along. Not only these tools minimize the human effort but also help the entire business process to run in an orderly way and thus led to improved customer satisfaction.

SIBRO offers more than you THINK!

We waited until we could do it right. Then we did! Checkout the incredible features of Sibro, the best insurance broker software in India, Philippines and Botswana.

SEE ALL SIBRO FEATURES

Best Insurance CRM Software for Brokers

With a full package of these features, anybody can marvel in the field of insurance without having extra staffs to produce referrals and guarantee client retention.