One of the common misconceptions that insurance professionals have is that people are always looking for products and services with less cost. They think that majority of the customers are attracted to the cost factor rather than quality.

But unfortunately, it is not true.

Of course price is one of the primary driving factors for insurance products. But there are other aspects always which demand equal considerations.

Think of what happen when you focus only on cost!

People will leave eventually. Because nowadays when searched in different websites, they could easily find hundreds of much cheaper quotations that you offer. Even a call center employee who has enough marketing vocabulary skills will snatch your employee on a blink of an eye.

Here are the best tips for you to use while selling your insurance

Ask why you bought other necessities and relate

Drive them to casual conversations and ask them the reason why they bought the basic amenities that they have the ownership right now. Ask them what the real driving factor to make that purchase was. Then relate them with the importance of insurance and the security it provides. Make them understand that it is also a necessity.

Explain about the claim benefits

Describe about how transparent your claims management is. Draw them the idea about how you help them in snatching their claims when a situation occurs. Use every opportunity explains the claim benefits because this is one major thing that people gets attracted when it comes to insurance selling.

Explain about a real time claim experience

Include real time claim experiences in your conversations. Make them believe that they are on the right business engagements. Explain the roadblocks and how you helped them overcome those barriers. Motivate them and drive him to a prospective business conversion.

Ask questions

Ask them with what they will do with the money saved if they didn’t chosed an insurance happened. Never make mistakes by showcasing wrong products. In order to be customer centric try to understand who they really re what they actually wants. Asking genuine costs will help you to clear your doubts.

Defend your product price

Even if the customers argue about your product’s price, defend it. Try to convince them with the quality of service that you provide compared to less quoted policies. Try to feed them with the value that you offer. Never ever apologize for your products pricing.

Explain your automated business process

Brief them about how your automated business process works. The stages and guaranteed service offerings and everything. These attributes will let customers to understand about the transparency and authenticity of your business.

If you don’t have an automated business process right now, check our Sibro.

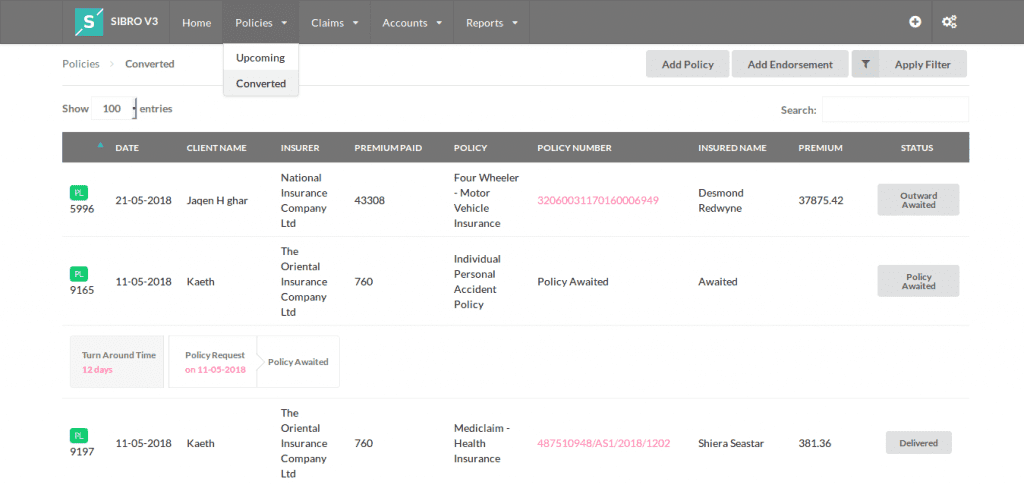

SIBRO offers more than you THINK!

We waited until we could do it right. Then we did! Checkout the incredible features of Sibro, the best insurance broker management software in India, Philippines and Botswana.

SEE ALL SIBRO FEATURES

Best Insurance CRM Software for Brokers

Sibro helps you organize and track every stage of a policy; from prospects & renewal follow-ups, preparation of RFQs & quote comparison, to collecting payments, and delivering policies to customers in order, their endorsements, and more.