From prospects to claims management, insurance broker software can offer modern insurance broker a ton of benefits. Enhanced data management, improved efficiency and superior customer support are the top features among the many.

Here we look at the most recommended insurance broker software features that enhances brokers to maximize their selling capability on a consistent basis.

#1: Ability to import prospects automatically

Prospect import is one huge feature that every brokers wish to have in their armory. It’s not just because of helping them to instantly upload every prospect but also assist them to upload each and every new prospects data systematically and more over error free.

This feature can make a huge impact on your daily work life and help you to be more consistent in your prospect management process.

#2: Automated policies management

POLICIES!!

Yeah, it is everything!! SO TREAT THEM WITH ATMOST CARE.

This should be your motto. Your success is very much defined by how you manage your policies and everything that comes with it.

Well then, prioritize this feature. This is something that keeps you in the gam no matter what. Being with an insurance broker software that offers automated policies management will definitely help you to achieve more and more sales throughout.

SIBRO offers more than you THINK!

We waited until we could do it right. Then we did! Checkout the incredible features of Sibro, the best software for insurance brokers in India, Philippines and Botswana.

SEE ALL SIBRO FEATURES

Best Insurance CRM Software for Brokers

#3: Provision to capture and manage the number of lives covered in a policy

These are brand new feature additions that only the best insurance broker softwares possess. You will only find features like these if you dive much deeper into the ocean.

This feature can help you capture the number of lives that has to be covered in a policy which makes your entry more precise and accurate.

If your insurance broker management software could address different mico features like these, then you are definitely having a good time with your insurance broker software.

#4: Lost business reports

Ever thought of keeping the lost client data. But some of the prominent insurance broker software has thought of it.

These data can help you to understand the reasons for your lost businesses and help you to overcome those hurdles and move forward with more energy in the future client hunting process.

#5: Custom download feature

Download only what you what. It is as simple as that. You may need numbers, figures, statistics, and a lot more.

But you may not every everything every time. Right data at the right time can do wonders. That’s why the best insurance broker software offers a custom download feature when you can prefer what and when to download.

It not only save data but also eradicates the confusion caused by the bulk amount of data.

For Best Insurance Broker Software!

We waited until we could do it right. Then we did! Checkout the incredible features of Sibro, the best insurance broker software for insurance broking companies in India, Philippines and Botswana.

BOOK A DEMO

#6: Exclusive multi-currency support

Business expansion is always the near future for every aggressive insurance broker. So if you need to play globally, then you have to consider the variation in currency in different countries.

What if your insurance broker software can take care of all those? Then the process is quite simple right.

If you explore some of the top-rated insurance broker software available in the market right now, you can experience the multi-currency support feature where you have an option to add “Additional Currencies” apart from the primary currency we loaded.

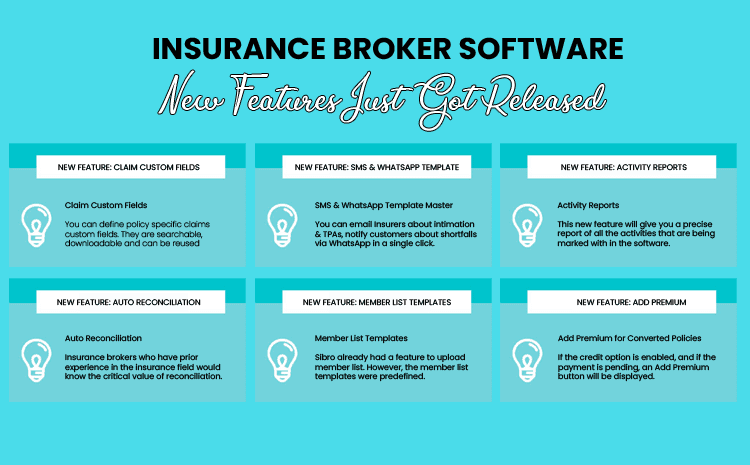

#7: Instant activity reports

Tracking your business activities is always a big deal.

Brokers always wondered if they could have a GOD’s eye where they can see and track each and every activity that is happening within their business.

Well, now we have an answer for that. Some of the latest insurance broker softwares are coming up with activity reports where you get a precise report of all the activities that are being marked within the software.

#8: Invoice sorting functionality

Invoices are always the hardest documents to handle in one way or other. To make it much simpler, insurance broker software makers have now come up with a feature where you can sort your invoices by invoice date followed by invoice number. Date-wise sorting is also possible. If there is more than one invoice on the same date, the system will sort in the descending order of invoice numbers.

#9: Managing discounts

If there are any amounts that you need to show legally apart from the premium amount, then discounts will be a better option. With this feature, you can record the discounts that you provided to your customers.

Do you need some help in automating your claims?

Visit our support center to get start with SIBRO

#10: Preset member list templates

The member list templates were predefined and help brokers to go through the member list recording process easily and effortlessly. From now on, member lists templates are customizable. You can create as many member list templates as you want.

#11: Auto reconciliation

Account reconciliation is done to compare the transactions you have recorded in your company’s financial accounts with the statements from external sources like banks or other financial institutions. This ensures that account statements balance with each other. It is vital if you want to produce accurate, reliable, and top-quality financial statements.

So, there is no question about the relevance of this feature.

The only job of the insurance broker is to go for an insurance broker software that offers these amazing features which will make your future much easier.