NEW ON JULY 27, 2020

Sibro introduces a new feature called Tax Master that helps us manage different tax rules of different countries effortlessly. The process is quite simple.

Previously GST & TDS were the default tax names. If it had to be changed to VAT or Service Tax or Withholding tax, and if you had to edit it, you should have done it via Translations. But from now on, with Tax Master, you can more effortlessly set up your desired tax names, and its corresponding rates.

How to change the tax name and rate in Tax Master?

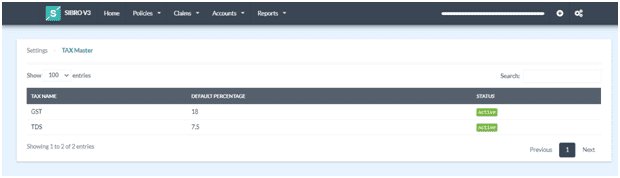

To set your tax options, click on the Settings icon → Organization →TAX Master. Here you can see the equivalent tax types listed here.

Note: You should need admin rights to access the Settings page.

From the above screenshot, two tax rates can be seen. You can simply click on any of those and change the tax name and its percentage. You can simply change the GST to VAT or Service Tax and TDS to With Holding Tax if required. The corresponding rates can also be changed as per your country’s regulation.

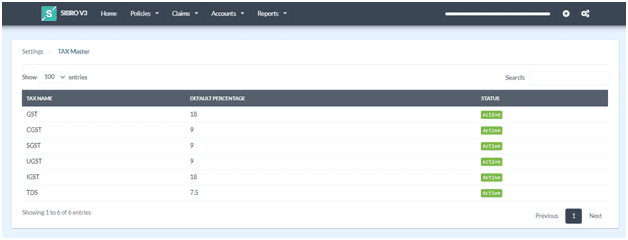

For countries with more complicated tax structures, country specific tax rules will be additionally available.

For example, when the country is set as India, instead of the simple tax master, the more advanced india specific tax master will be loaded – which can be renamed, updated, etc.

So if you want to define tax rates applicable for your country, Sibro now more easily helps you configure it with Tax Master