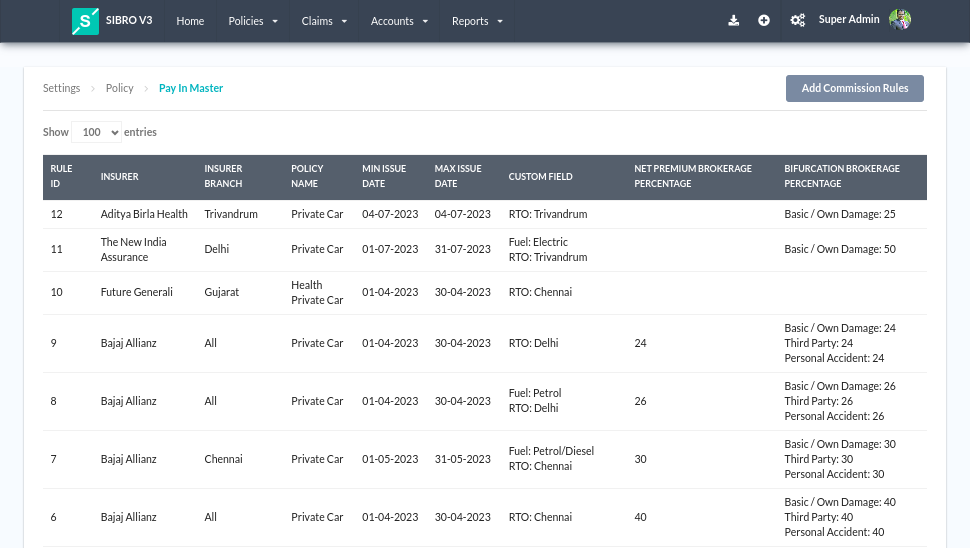

Pay In Master helps you define brokerage receiveable auto calculation rules based on various parameters like Insurer, Product, Date Range, and Custom Conditions.

For example, the Insurance company ICICI Lombard may say that for Private Car Policies issued in July 2023, they will pay 30% of the Net Premium. For Private Car Policies issued in August 2023, the insurer will pay 27% of the Net Premium.

At the same time, the Insurance company HDFC Ergo may say that for Delhi-based Petrol Private Car Policies issued in July 2023, they will pay 35% of the Net Premium. For Delhi-based Non-Petrol Private Car Policies issued during the same period, the insurer will pay say 18% of the Net Premium.

You can define such Insurer wise, product-wise, custom condition-wise brokerage receiveable rules using the Pay In Rules. The following video explains how to set it up.

Points to note:

Pre-requisite: You should be thorough with the Policy Custom fields concepts.

You should have the Master access at user master to get access to the Pay In Master. If you have the privilege, go to Settings > Policy > Pay In Master. You will be able to Add and Edit Payin Rules.

Note that only Drop-down type Policy Custom fields will be available in the Pay In Rule Conditions. Text, Date, and attachment type Policy Custom fields cannot be used in the Pay In Master.

At Policies > Converted > Policy Issued Step, the system will only suggest the Policy Master Default rates as Brokerage Receivable. However, on save, the system will go to the Pay In rules and try to find the best matching pay in rule and update the Brokerage Receivable.

If there are multiple rules at Pay In Master that fully matches the Issued Policy, then the system will try to find the rule that has the highest number of full match. If the system is not able to resolve to a single rule, then the Latest Rule among the highest number of full matches is selected.